Didn’t have the greatest nights sleep, must be said. Started on time. Lots of annoying people. Phoned the accountant people and made an appointment for twenty minutes later. Walked to them as they are just up the road. Had a very nice meeting with a lovely lady. Basically all my calculations and theories were correct, I’m paying 60% tax on a portion of my earnings, I ain’t happy with that. So it turns out my way of reducing this somewhat is legitimate, providing I’m willing to stand in front of the tax man and state that what I’m buying is work work purposes, which it is. Even though as accountants they’ve never come across a case of an employee claiming capitol allowances, although there is nothing to stop you and even a box to put the number in. It comes down to, “Do your employers provide everything required to do your job, and is it stated in your contract.” The answer to that is ‘no’, unless they want to pay for my entire network infrastructure. So I have some hardware to purchase, I’m also going to put a significant amount into one of my private pensions, not that I wanted to, but I’m buggered if I’m losing 60p in the pound for bugger all. We discussed going back as a contractor, considering the perks of me being an employee are absolutely zero. It would be advantageous if I went back to a limited company. I opened my own again today anyway. I spoke to our corporate accountant about it, his response was, ‘There are no real advantages and the tax people won’t let you do it’. This is the same guy who’s clueless about personal allowances eroding. If I want to resign and become a contractor then that’s exactly what I’ll do.

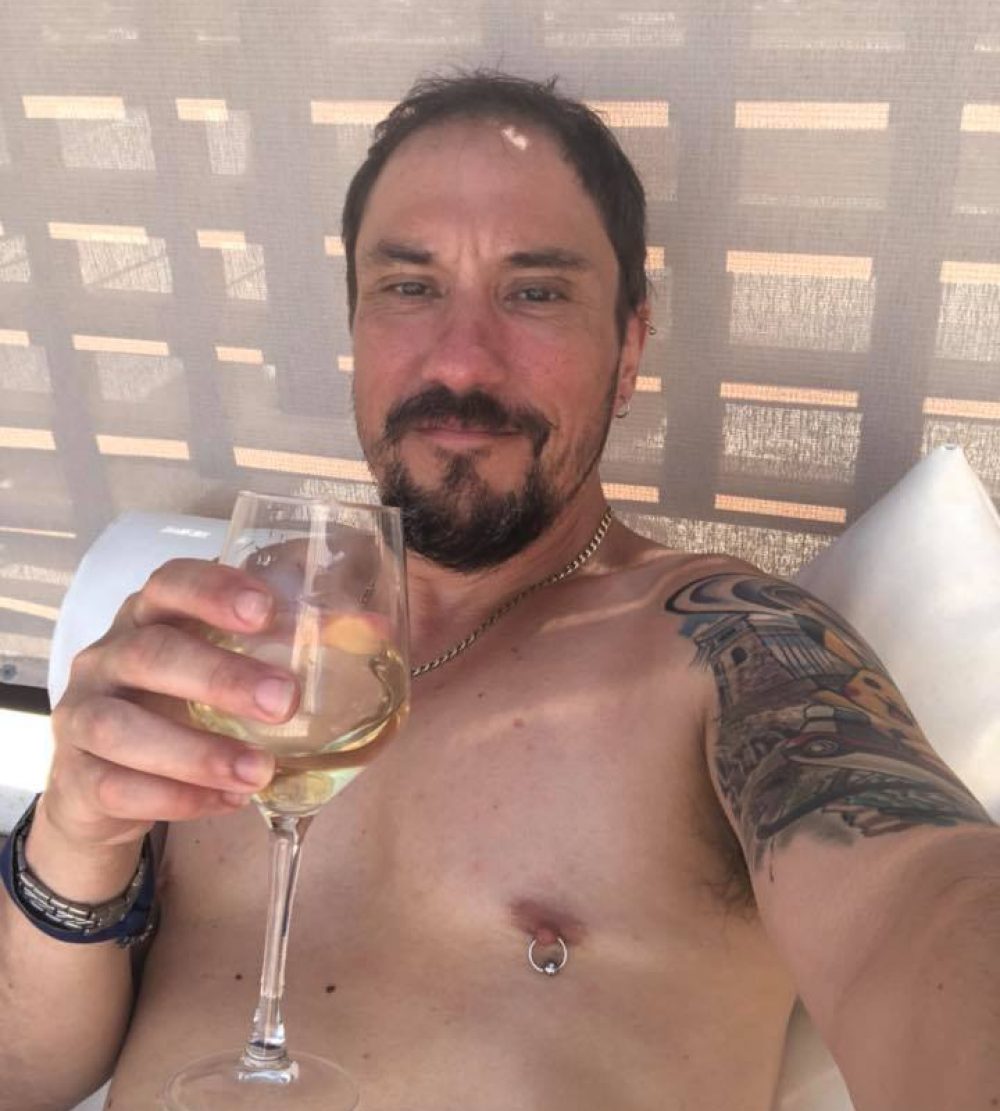

Mannmansion

Waffling from a bloke who drinks too much wine and has issues with Jesus